Economists Emphasize Employment Generation and Manufacturing Boost in Upcoming Budget

During a pre-Budget consultation with Finance Minister Nirmala Sitharaman, economists stressed the importance of focusing the upcoming Budget on employment generation and strengthening the manufacturing sector. Highlighting concerns over unemployment, they urged the government to prioritize job creation. There was a consensus that with the economy showing resilience, stimulating consumption demand would not be a significant challenge.

Economists participating in the consultation, including National Co-convenor of Swadeshi Jagran Manch Ashwani Mahajan, Director and Chief Executive of the Institute for Studies in Industrial Development (ISID) Nagesh Kumar, and TCA Anant, emphasized these priorities.

Key Points from the Consultation

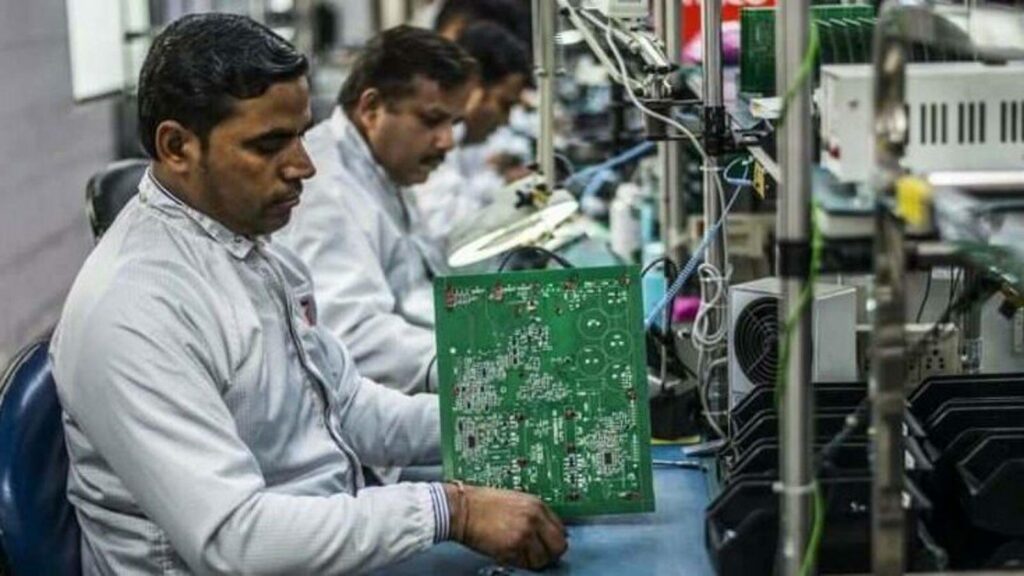

– Employment Generation: Economists highlighted unemployment as a major issue and recommended the government focus on creating jobs.

– Manufacturing Sector: Emphasis was placed on promoting the manufacturing sector, with a particular focus on MSMEs and the textile industry. Nagesh Kumar suggested expanding the scope of the Production Linked Incentive (PLI) scheme.

Statements from Participants

After the meeting, Ashwani Mahajan mentioned that “unemployment is a big issue, and the government should focus on generating jobs.” He added that given the economy’s resilience, consumption demand would not pose a problem.

Nagesh Kumar noted the need to push the manufacturing sector and called for incentives to support MSMEs and the textile sector. He also recommended expanding the PLI scheme to further promote manufacturing.

Official Statement

The Ministry of Finance posted on X (formerly Twitter) about the meeting: “Union Minister for Finance & Corporate Affairs Smt. @nsitharaman chairs the first Pre-Budget Consultations with leading economists in connection with the forthcoming General Budget 2024-25 in New Delhi, today.” The post also mentioned the attendance of Union Minister of State for Finance Shri @mppchaudhary, Finance Secretary, and other key officials.

Upcoming Budget Presentation

Finance Minister Nirmala Sitharaman is expected to present the Union Budget for the 2024-25 fiscal year in the last week of July.