Govt to Extend Easy Visa Rules to All PLI Sector Companies: DPIIT Secretary

The Production-Linked Incentive (PLI) scheme covers 14 sectors, including mobile phones, drones, white goods, telecommunications, textiles, automobiles, specialty steel, and pharmaceutical drugs. The government is working towards streamlining the application process for Indian business visas for companies that have set up manufacturing units in these sectors but are not direct beneficiaries of the PLI scheme.

“We have already streamlined the process for PLI beneficiaries. We’re now trying to extend this streamlined process to non-PLI beneficiaries operating in those same strategic sectors. We are currently drawing up a similar streamlined process for these non-PLI beneficiaries,” said Rajesh Kumar Singh, Secretary of the Department for Promotion of Industry and Internal Trade (DPIIT), which operates under the Ministry of Commerce and Industry, on Thursday.

While a final decision has yet to be made, the government is moving in this direction. “Visa-related matters fall under the purview of the Ministry of External Affairs and the Ministry of Home Affairs,” Singh added.

Earlier this week, Commerce and Industry Minister Piyush Goyal told Business Standard that the government is expediting visa-related issues to bring technicians to India from China and other countries as needed to ensure the smooth implementation of the PLI scheme.

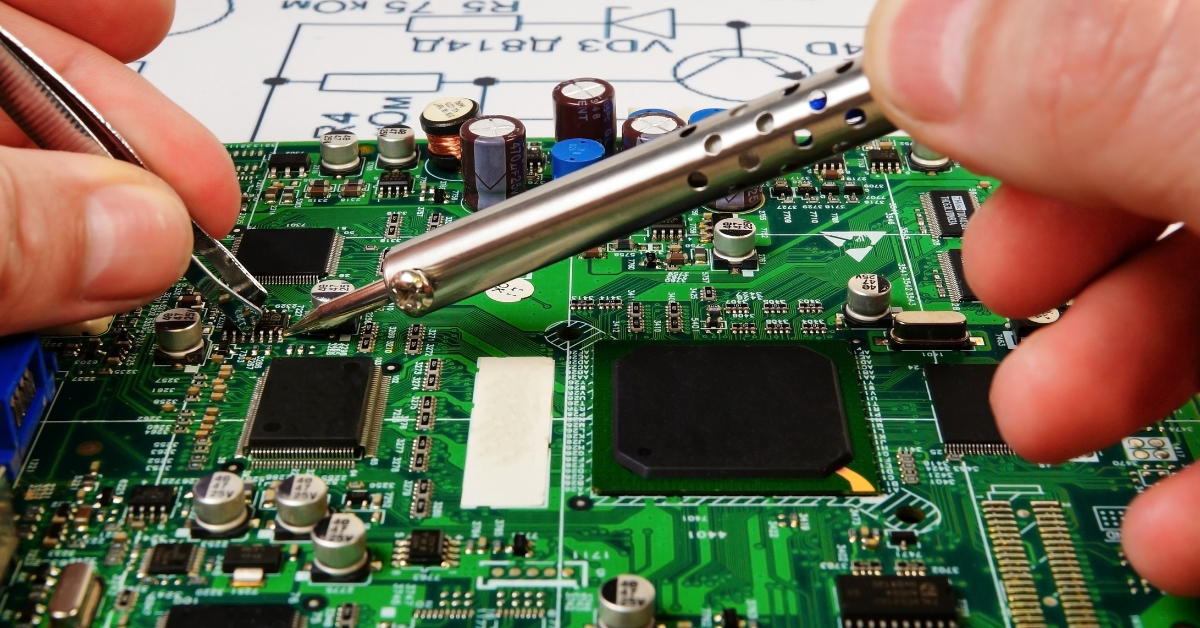

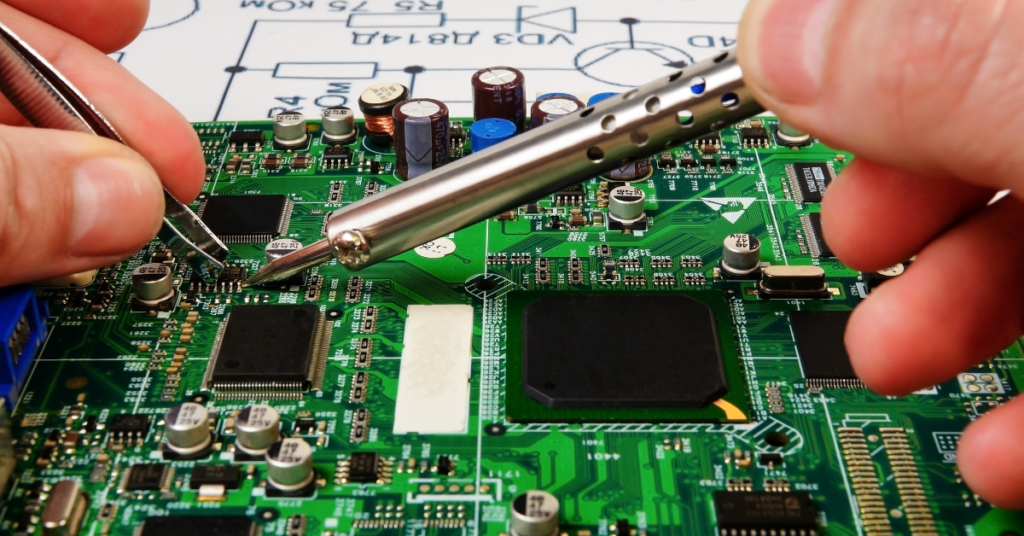

The industry has sought government intervention to resolve visa-processing delays affecting Chinese vendors involved in manufacturing projects. Companies have faced productivity issues due to visa hurdles in areas ranging from component manufacturing to the installation or repair of machinery, especially under the PLI scheme.

Several ministries and government departments have been addressing outstanding visa-related issues for experts and technicians from China with the Ministry of External Affairs. DPIIT has also been coordinating these matters with the external affairs ministry.