A report by the Confederation of Indian Industry (CII) emphasizes the need for critical actions to transform India’s electronic sector ecosystem from “import-dependent assembly-led manufacturing” to “component-level value-added manufacturing.”

Key Findings

According to the report, in 2023, the demand for components and sub-assemblies reached USD 45.5 billion, supporting USD 102 billion worth of electronics production. This demand is projected to surge to USD 240 billion, supporting USD 500 billion worth of electronics production by 2030.

Growth Projections

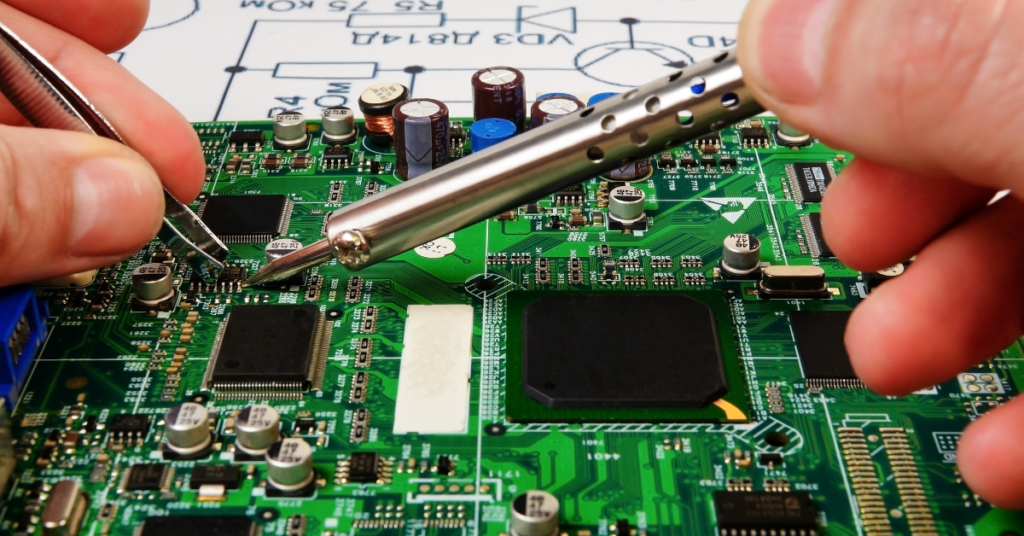

Priority components and sub-assemblies, including Printed Circuit Board Assemblies (PCBAs), are expected to grow at a robust Compounded Annual Growth Rate (CAGR) of 30%, reaching USD 139 billion by 2030.

Recommendations for Government Action

The report recommends several key actions for the government, including:

– Introducing a fiscal support scheme, SPECS 2.0 (Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors).

– Rationalizing import tariffs on components like camera modules.

– Signing Free Trade Agreements (FTAs) with European and African countries.

Priority Components

The report identifies five priority components and sub-assemblies as high priority for India: lithium-ion batteries, camera modules, mechanicals, displays, and PCBs. These components accounted for 43% of the components demand in 2022 and are expected to grow to USD 51.6 billion by 2030.

Current Challenges

These components are either minimally produced in India or are heavily import-dependent. Sustaining this trend of importing priority components is not viable. The PCBA segment, which relies heavily on imports, is expected to grow by 30%, creating a demand of around USD 87.46 billion by 2030.

However, India faces several challenges, including:

– Manufacturing cost disadvantages compared to economies like China, Vietnam, and Mexico (10-20%).

– Lack of large domestic manufacturing corporations.

– Absence of a domestic design ecosystem for Indian companies.

– Insufficient raw materials ecosystem.

Economic Benefits

The report suggests that policy support will yield various economic benefits, such as:

– Job creation for approximately 280,000 people by 2026.

– Increase in domestic value addition from current levels.

– Reduction in import dependency.

– Increase in GDP.

These measures will help firmly position India as a global hub for electronics manufacturing by 2030.