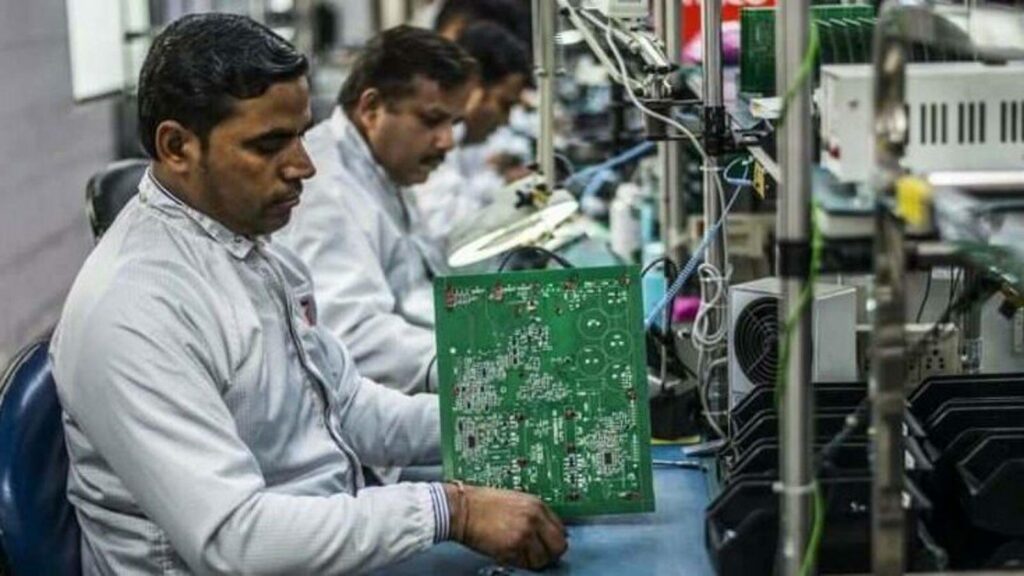

The manufacturing sector in India has emerged as a strong investment opportunity, with around $2 billion in investments growing at a 20 percent CAGR over the last two years (2021–23).

Indian private equity and venture capital (PE-VC) investments softened to approximately $39 billion in 2023, reflecting a global trend, according to a report by Bain & Company. Traditional sectors such as manufacturing, healthcare, and energy demonstrated resilience, accounting for about 75 percent of investments in 2023, up from 60 percent in 2022.

The growth in the manufacturing sector, driven by supply chain diversification, government incentives, and the availability of scale assets, was highlighted in Bain & Company’s annual ‘India Private Equity Report 2024’, created in collaboration with the Indian Venture and Alternate Capital Association (IVCA).

With electric vehicle (EV) penetration in India expected to reach 40 percent by 2030, original equipment manufacturers (OEMs) dominated more than 70 percent of deal value in the past year. Significant investments (over $100 million) were made in companies such as Ola Electric, Ather Energy, Mahindra EV, and TI Clean Mobility. Additionally, packaging saw substantial deals in globally competitive companies with strong export performance, including Polyplex and Tufropes, both generating over 70 percent of sales from exports.

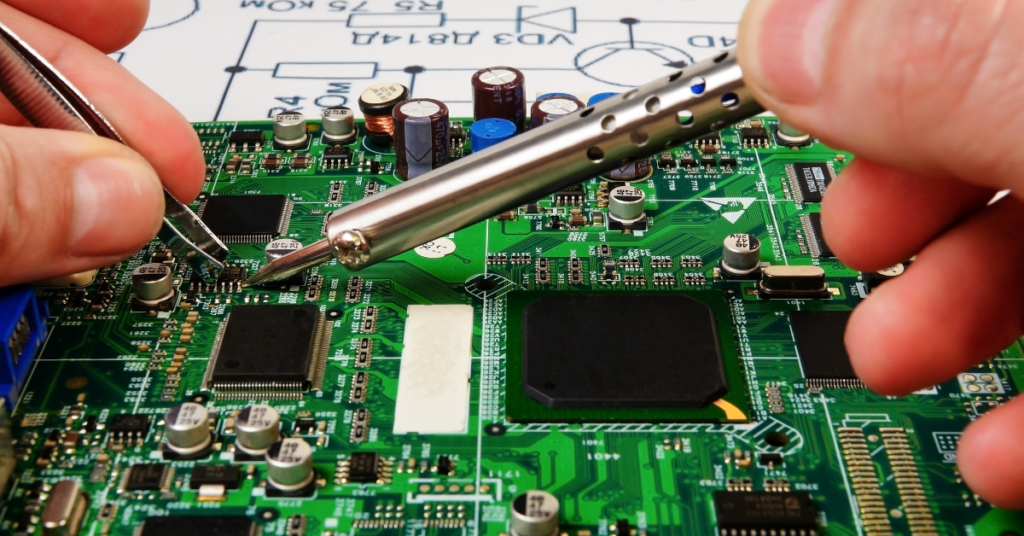

Gustaf Ericson, Associate Partner at Bain & Company, stated, “Advanced manufacturing is expected to see increased deal activity in the near to mid-term, driven by China+1 tailwinds, government incentives like PLI, and the emergence of scaled assets across multiple segments. We expect electronic manufacturing services, packaging, and EV players to benefit significantly from this favorable environment in the coming years.”

Despite a temperate outlook for India PE-VC dealmaking in 2024 due to global macroeconomic stabilization, traditional sectors such as advanced manufacturing are poised to attract substantial investments. This is attributed to positive fundamentals, supportive policies (like production-linked incentives and tax incentives), and the growth of scale assets across various sub-segments.

The EV market is anticipated to experience robust deal activity, especially in OEMs with scale assets planning capacity expansions or new product launches, as well as in charging infrastructure and battery-swapping players looking to expand geographically or into new EV segments.

Key investment drivers are expected in plastics, secondary paper, and glass, propelled by the F&B industry’s demand for premium, lightweight, cost-effective plastics, and the e-commerce sector’s shift towards sustainable packaging. Revenues for India-based packaging companies are projected to grow at around 10 percent CAGR between 2023-27.

Electronics production in India is forecasted to grow at a 25 percent CAGR over 2023-27, with mobile phones, IT hardware, and consumer electronics being the most attractive sub-segments for deal activity. This growth is driven by increased smartphone and consumer durable penetration, faster replacement cycles, significant export uptake by leading players, increased backward integration (e.g., into components), and a favorable duty structure for import substitution.

Additionally, global supply chain diversification is likely to benefit Indian manufacturers in export-oriented sectors like electronics, pharmaceuticals (especially APIs and CDMOs), and chemicals (specialty chemicals and agrochemicals), given their globally competitive scale and robust government support.

The Bain & Company report also noted that India-focused funds are increasingly diversifying across various sectors. Leading funds entered new sectors from 2021–23, with manufacturing, healthcare, new-age tech, and SaaS attracting the most new investments.

In 2023, India saw $29.6 billion in PE investments during a subdued year for private equity globally, marking an 18 percent drop from 2022’s peak value of $36 billion. PE accounted for around 75 percent of total PE-VC deal value, driven by large-scale deals for high-quality assets. VC investments dropped significantly to $9.6 billion in 2023 from $25.7 billion in 2022, as investors prioritized unit economics over growth and recalibrated strategies amid macroeconomic challenges.